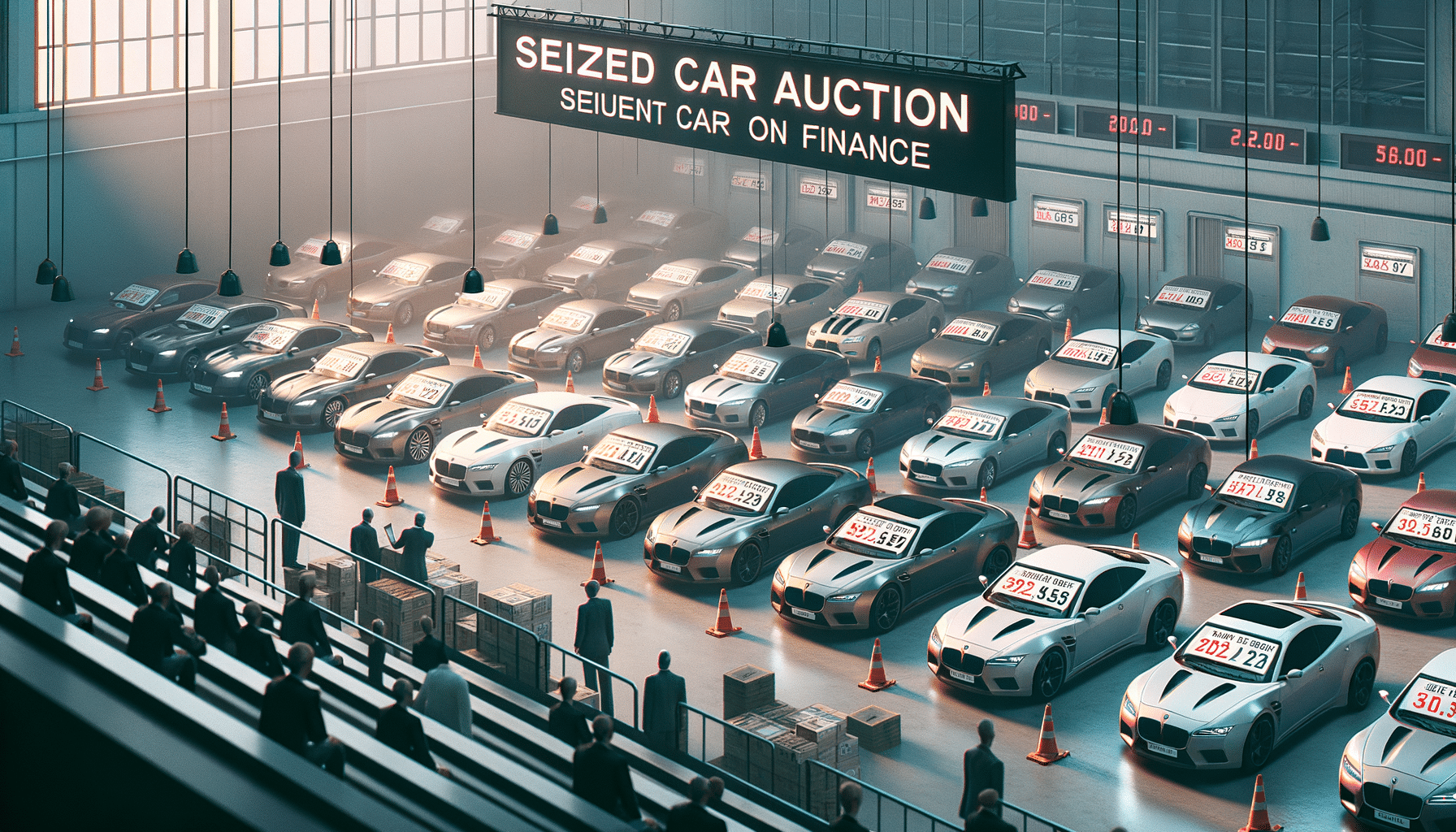

Why Seized Cars on Finance Sell for Less: Inside Government Auctions & Bargain Deals

Understanding the Concept of Seized Cars on Finance

Seized cars on finance represent a unique segment of the automotive market, often misunderstood by potential buyers. These vehicles are typically repossessed by financial institutions when the original owner fails to meet the payment obligations of their car loan. This process, although unfortunate for the initial owner, opens up opportunities for buyers looking for affordable options.

The concept is straightforward: when a borrower defaults on their car loan, the lender has the legal right to repossess the vehicle. This is often done without prior notice, and the car is then sold at auction to recover the outstanding debt. These auctions are typically organized by government agencies or financial institutions, offering vehicles at prices well below their market value.

Understanding why these cars sell for less involves considering several factors. Primarily, the need for lenders to quickly recoup their losses leads to lower starting bids. Additionally, the condition of the cars can vary, as they might have been neglected by the previous owner. However, for those willing to do their homework, seized cars on finance can be a financially savvy purchase.

Why Seized Cars Are Cheaper: The Economic Dynamics

The economic dynamics behind why seized cars are cheaper are rooted in the urgency of financial institutions to liquidate assets. When a car is seized, it is considered a non-performing asset, which means it is not generating revenue for the lender. To mitigate losses, these institutions aim to sell the vehicles as quickly as possible.

Several elements contribute to the reduced prices:

- Quick Turnaround: Financial institutions prefer a quick sale to recover funds, often setting starting bids below market value to attract buyers.

- Condition Variability: Seized cars may come with wear and tear or require repairs, which can deter some buyers, further lowering prices.

- Market Perception: There’s a stigma attached to repossessed cars, with potential buyers fearing hidden issues, which can drive prices down.

Despite these factors, many of these vehicles are in good condition and offer excellent value for money. Buyers who are diligent in their research and inspections can find remarkable deals.

Participating in Government Auctions: What You Need to Know

Participating in government auctions where seized cars are sold can be an exhilarating experience. However, it requires preparation and understanding of the process to ensure a successful purchase. These auctions are open to the public and can be attended in person or online, depending on the organizing body.

Here are some key points to consider:

- Research: Before attending an auction, research the vehicles available. Most auctions provide a catalog of the cars, including details about make, model, and condition.

- Set a Budget: Determine how much you are willing to spend. It’s easy to get caught up in the excitement of bidding, so having a clear budget helps you stay grounded.

- Inspection: Whenever possible, inspect the vehicle before bidding. While some auctions offer inspection days, others may not, so it’s crucial to gather as much information as possible.

By understanding the auction process, setting a budget, and conducting thorough research, buyers can navigate these auctions successfully and potentially secure a great deal on a seized car.

Common Pitfalls and How to Avoid Them

While buying a seized car on finance can be a great opportunity, there are common pitfalls that potential buyers should be aware of. Avoiding these pitfalls requires vigilance and a strategic approach to the buying process.

Some common issues include:

- Unseen Damages: Cars sold at auction may have hidden mechanical issues. It’s crucial to either inspect the car yourself or bring a knowledgeable friend or mechanic to assess its condition.

- Overbidding: The excitement of an auction can lead to overbidding. Stick to your budget to avoid paying more than the car’s worth.

- Lack of Warranty: Most seized cars are sold “as-is,” meaning there are no warranties. Buyers should be prepared for potential repairs.

To avoid these pitfalls, thorough research and preparation are essential. By understanding the risks and taking steps to mitigate them, buyers can make informed decisions and enjoy the benefits of purchasing a seized car on finance.

Maximizing Value from a Seized Car Purchase

To maximize the value from a seized car purchase, buyers should focus on strategic planning and post-purchase care. Once you’ve successfully bid on a car, there are several steps to ensure you get the most out of your investment.

Consider the following strategies:

- Immediate Maintenance: After purchasing, have the car thoroughly inspected and serviced. This can prevent minor issues from becoming major problems.

- Documentation: Ensure all paperwork is in order, including the title and any service records provided. This is crucial for future resale value.

- Regular Upkeep: Maintain the car regularly to preserve its condition and value. Regular check-ups and timely repairs can extend the vehicle’s lifespan.

By taking these steps, buyers can ensure their seized car remains a valuable asset, providing reliable transportation and potentially offering a return on investment if resold.